A Multi-Polar World and a Re-pricing of Financial Assets

As always, our Market Notes reports are available to you in PDF format. Click below to download.

First, an update:

Last year, we at Consilience Asset Management added a Macro-Economic component to our Relative Capital Flow Model*. Using market action, through a process of reverse engineering, we seek to identify which macro-economic climate is being represented in the market at any given time.

This is an important addition to our discipline as central banks across the globe are attempting to unwind decades of monetary expansion. As this unwinding occurs, it could have significant ramifications for the financial market. Thus, there is an increased need to monitor this process and the corresponding macro-economic result.

Below are the ratings of securities in the five scenarios that we are monitoring:

Inflation – Neutral,

Deflation – Neutral,

Stagflation – Negative,

Recovery – Neutral,

Financial Crisis – Neutral.

The above scenarios reflect the current Capital Flow* composite rating of the securities that have historically generated positive returns in the above economic environments.

In addition, our Global Macro Indicators* are as follows for the seven asset classes we invest in for our clients:

Global Equities – Neutral,

Global Bonds – Negative,

Commodities – Neutral,

Gold – Neutral,

U.S. Dollar – Negative,

Real Estate – Neutral,

Cryptocurrencies – Positive.

Now, to this month’s report:

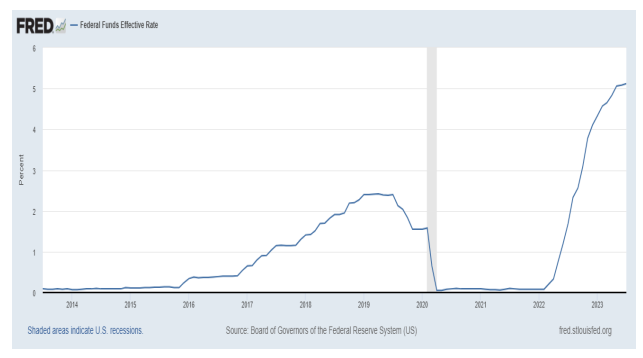

In the wake of the 2008 financial crisis by increasing its balance sheet through quantitative easing we experienced over a decade of artificially low-interest rates and easy money as the US money supply expanded to record levels.

In late 2021, the Fed reversed course by announcing they were about to start raising rates and shrinking its balance sheet through quantitative tightening to fight price inflation. As a result, the stock market went on a bear run last year.

In late 2022 the Fed again reversed course through fiscal measures, adding an additional approximately $1Trillion to the budget deficit for the 12 months ending this month. Stocks rallied as this stimulus added liquidity to the financial markets and the hope that the tightening cycle has ended.

Unfortunately, the CBO estimates this fiscal impulse is likely to fade significantly over the next 12 months.

Further, there is evidence that the recent rally in stocks was driven entirely by technicals, positioning, sentiment, liquidity and post-bank crisis Fed easing with zero fundamental contribution.

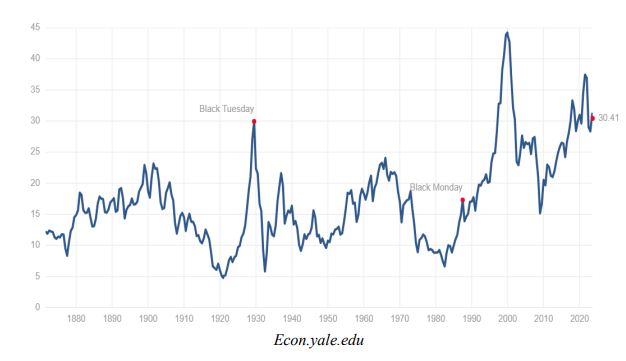

Despite enthusiasm about the market rebound since October, equity market valuation measures remain more extreme than at any point in history prior to July 2020, (with the exception of a few months directly surrounding the 1929 peak, and two weeks in April 1930).

Ok… the Fed has been the driver for stocks and bonds for four decades and the impact became most dominant following the 2008 financial crisis. But this is old news. Today, I believe we are witnessing a new driver for global financial assets…

BRICS

BRICS is an association of five major countries including Brazil, Russia, India, China, and South Africa. Distinguished by their emerging economies, the group has sought to improve diplomatic coordination, reform global financial institutions, and ultimately serve as a counterbalance to Western hegemony.

And they just expanded… being named BRICS+6 or BRICS-11.

Why should the ongoing expansion of Emerging Markets in the form of the recent BRICS+6 expansion be of concern to investors?

As summarized by the IMF, Emerging Markets represent:

• 87% world population,

• 76% oil supply,

• 73% CO2 emissions,

• 54% FX reserves,

• 46% nuclear weapons

• And 20% global equity market capitalization.

In addition, the new "BRICS-11" holds $1.5 trillion of US Treasuries, making it the largest single US creditor.

What are the risks?

According to Russian finance expert, Sergei Glasyev, this is the beginning of a move among the Eurasian Economic Union for cross-border trade settlements backed by local currencies and commodities.

Glasyev has also disclosed plans for a Moscow World Standard, a fair-priced gold exchange alternative to the Western London Bullion Market Association (LBMA) exchange.

In addition, according to The Economic Times the Shanghai Cooperation Organization has announced a plan to expand such gold-backed trade currency in as many as 41 Emerging Countries.

This could ostensibly mean greater than 50% of the world’s population and GDP would be trading in a gold-backed settlement currency outside of the USD.

Tag on the fact that Brazil, China and Iran are trading outside the USD-denominated SWIFT payment system, and it seems fairly clear that much of the world is leaning toward a “commodity rather that debt-based trade settlement currency.”

Can we really blame them for wanting to move away from dollar-denominated trading? This is all developing while Washington continues a seemingly unbridled spending spree under the assumption “more spending” is better, debts and deficits matter.

But recent history shows that debt and deficits do matter. And the rest of the world is taking note.

Asd the US has continued to spend and dilute the purchasing power of the dollar, there has also been a marked decline in US economic growth.

If you take a close look at the following chart, you’ll note GDP growth ran between 0-8% on average from the 1950’s through the early 1980’s, then 0-5% for the next 15 years and 0-2.5% in the past two decades. All the while, as shown above, this occurred as the US continued to pile on debt.

The case can be made the surge in debt is the culprit of slowing rates of economic growth. According to the Center On Budget & Policy Priorities (CBPP), roughly 88% of every tax dollar today goes to non-productive spending.

The irony is that debt-driven economic growth consistently requires more debt to fund a diminishing rate of return on future growth. The CBPP estimates that it now requires $3.02 of debt to create $1 of real economic growth.

This is not going unnoticed, either here or abroad as shown above.

First here. Two weeks ago, Fitch Ratings downgraded the US’s long-term credit rating from AAA to AA+. This should serve as a wake-up call because there is a much bigger problem looming on the horizon: a market-driven downgrade of the US dollar as foreign competition against the dollar is brewing.

Remember, the US dollar is the reserve currency for global trade. This creates a continual demand for dollars, thus propping up its value. Any challenge would potentially result in a reduction of the dollar’s value and even higher inflation and interest rates in the US.

As it stands, the majority of global oil sales are priced in dollars. This ensures a constant demand for the greenback since every country needs dollars to buy oil. This helps support the US government’s “borrow and spend” policies, along with its massive deficits.

This means that as long as the world trades in dollars the Federal Reserve can keep printing dollars to monetize the debt.

But this is all beginning to change.

.

For example, China has been pushing for oil trade to be denominated in yuan, and that Saudi Arabia’s acceptance into BRICS could bolster this ambition, potentially shifting the dynamics of global oil trade away from the US Dollar.

Recently, according to Bloomberg, the Chinese central bank revealed that in July it increased its gold reserves for a ninth straight month as it continues to diversify its reserves away from the US dollar.

In another blow to dollar dominance, according to Bloomberg, India and the United Arab Emirates settled an oil trade without converting local currencies to dollars for the first time on Monday, as India’s top refiner made a payment for oil in rupees.

Indian Oil Corp. bought a million barrels of oil from Abu Dhabi National Oil Company in a dollar-free transaction. The oil sale was the first after the two countries entered a Memorandum of Understanding (MoU) in July. The deal established the Local Currency Settlement (LCS) system, facilitated by the Reserve Bank of India and the Central Bank of the United Arab Emirates. The system allows the two countries to engage in bilateral trade using the rupee and dirham.

According to a statement by the Reserve Bank of India, the agreement will facilitate “seamless cross-border transactions and payments and foster greater economic cooperation.”

India has also purchased oil from Russia using non-dollar currencies which is meaningful as they are the third-largest oil importer in the world.

If the trend of “dollarless” transactions expands to other countries, the minimization of the dollar in the global oil trade would be bad news for the United States.

As mentioned above, less demand for dollars would result in a further devaluation, thus higher inflation, less demand for our Treasury bonds, thus higher interest rates, leading to slower economic growth and headwinds for stock and bond prices.

In light of this, what should an investor do?

My advice is to pay close attention to our capital flow indicators as summarized at the beginning of this report and described below, and as they change, so should the asset allocation of your portfolio.

In our seven asset classes listed, there are both inflation and deflation sensitive options. It is my belief that it would be prudent for investors to allocate a portion of their assets outside the traditional markets of stocks and bonds (paper assets) and into alternative asset classes (hard assets). Some of these are included in our seven assets listed on page 1 of this report.

It is important to note that alternative investments can result in increased portfolio volatility and as with traditional investments like stocks and bonds, are not guaranteed and can decline in value.

Conclusion: Recognizing that we are in uncharted waters with multiple moving parts, we must admit that there is no way to tell in advance exactly how this will unfold. But in such a transitionary environment, the ability to properly anticipate change is predicated upon a detached analysis of information from multiple sources, applying that information to imagine a plausible world different from today’s, understanding how new data points fit (or don’t fit) into that world and adjusting accordingly.

Although this will be no easy feat, our answer at Consilience Asset Management is to employ a discipline that we believe has the ability to circumvent the effects of these uncertainties and disparities between the above noted risks and actual market action. Ultimately, it will be the forces of supply and demand that will drive prices of financial assets higher or lower, regardless of the fundamental, geopolitical or economic circumstances.

The cornerstone of our process is our Global Macro Capital Flow Model.

In this model, we monitor the movement of capital among the approximately $250 trillion of tradable global financial assets. Here, market trends can be identified regardless of their driver; debt, geopolitical, economic, or other…

Below is a picture of the distribution of the world’s liquid investment assets as a percent of the $250 trillion total…

By measuring the capital flows of each of these categories relative to the total, both favorable and unfavorable investment trends are identified.

At Consilience Asset Management, we employ this process in deploying client assets.

A more complete description of our model and process can be found on our website: www.consilienceassetmanagement.com under the tab “Our Process.”

Based on this, the ratings for each of the eight asset classes that we monitor are included each month at the beginning of this report.

We are entering a new phase, as the decade-long bull markets for stocks appear to be winding down. We are cognizant of the new challenges inherent due to the structural changes noted in this report, as they will have a huge impact on the current supply/demand dynamics in the global marketplace.

As such, we realize that these are clearly challenging and unprecedented times and therefore it is important for the astute investor to be nimble and pay close attention!

Consilience Asset Management

Roger Faulring – Managing Partner/Sr. Portfolio Manager/Investment Strategist

Michelle Malone – President/Investment Advisor

Donna Stone – Managing Partner/Investment Advisor

Roger Faulring is an Investment Adviser Representative (IAR) with and offers Investment Advisory Services through B. Riley Wealth Advisors, Inc., (BRWA) a SEC Registered Investment Adviser (RIA). BRWA and Consilience Asset Management are not affiliated.

All opinions and estimates included in this communication constitute the author’s judgment as of the date of this report and are subject to change without notice. The information provided is not directed at any investor or category of investors and is provided solely as general information about products and services or to otherwise provide general investment education. None of the information provided should be regarded as a suggestion to engage in or refrain from any investment-related course of action as neither B. Riley Wealth Management nor its affiliates are undertaking to provide you with investment advice or recommendations of any kind. Securities and variable insurance products offered through B. Riley Wealth Management, Inc., Member FINRA/SIPC.

*Our Global Macro Tactical Strategy seeks to identify favorable investment opportunities among seven primary asset classes. Capital is rotated to the specific markets in an effort to control risk by underweighting or eliminating exposure to markets that exhibit elevated risk.

*Our Relative Capital Flow Model is the cornerstone of our tactical allocation decisions and is augmented by our Behavior, Economic, Monetary and Stability indicators.

IMPORTANT NOTICES: The information contained in this electronic message (including any attachments) is privileged and confidential information intended only for the use of the recipient(s). Please notify the sender by email if you are not the intended recipient. If you are not the intended recipient, you are hereby notified that any dissemination, distribution or copying of this communication is strictly prohibited. B. Riley Capital Management, Inc. ("BRCM") does not accept time sensitive, action-oriented messages or transaction orders, including orders to purchase or sell securities, via email or by any other electronic means. BRCM reserves the right to monitor and review the content of all messages sent to or from this email address. Messages sent to or from this email address are stored by a third-party vendor and may be provided to regulators upon request. Neither the sender nor BRCM accepts any liability for any errors or omissions arising as a result of transmission. Any information contained in this electronic message is not an offer or solicitation to buy or sell any security, and while such information has been obtained from sources believed to be reliable, its accuracy is not guaranteed. Any references to the terms of executed transactions should be treated as preliminary only and subject to BRCM's formal written confirmation. This message is for information purposes only and is not an investment recommendation or a solicitation. Past performance is not indicative of future returns. All information is subject to change without notice. Unless indicated, these views are the author's and may differ from those of the firm or others in the firm. BRCM does not represent this is accurate or complete and may not update this information.