Is a Shift from “Paper” to “Real” Assets Beginning to Unfold?

As always, our Market Notes reports are available to you in PDF format. Click below to download.

First, an update:

Last year, we at Consilience Asset Management added a Macro-Economic component to our Relative Capital Flow Model*. Using market action, through a process of reverse engineering, we seek to identify which macro-economic climate is being represented in the market at any given time.

This is an important addition to our discipline as central banks across the globe are attempting to unwind decades of monetary expansion. As this unwinding occurs, it could have significant ramifications for the financial market. Thus, there is an increased need to monitor this process and the corresponding macro-economic result.

Below are the ratings of securities in the five scenarios that we are monitoring:

Inflation – Neutral,

Deflation – Negative,

Stagflation – Neutral,

Recovery – Positive,

Financial Crisis – Negative.

The above scenarios reflect the current Capital Flow* composite rating of the securities that have historically generated positive returns in the above economic environments.

In addition, our Global Macro Indicators* are as follows for the seven asset classes we invest in for our clients:

Global Equities – Neutral,

Global Bonds – Negative,

Commodities – Neutral,

Gold – Neutral,

U.S. Dollar – Negative,

Real Estate – Positive,

Cryptocurrencies – Positive.

Now, to this month’s report:

The financial markets over the last decade, due to massive monetary accommodation, have defied the laws of fundamentals and logic… and continue to this day.

For example, the market continues to be splendidly untroubled by inflation. But is this woefully misguided? Will inflation return, with a re-acceleration?

But wait, according to the St. Louis Fed, inflation dropped from 9.1% last June to 4.0% this May. Isn’t the Feds current monetary tightening strategy working?

If we dig a bit deeper into the numbers, there is more to the inflation story. The economic and financial puzzle has far more pieces to it than many people think.

The bulk of the fall in global inflation has been driven by weakness in China. But could policy easing in China cause inflation to begin rising again?

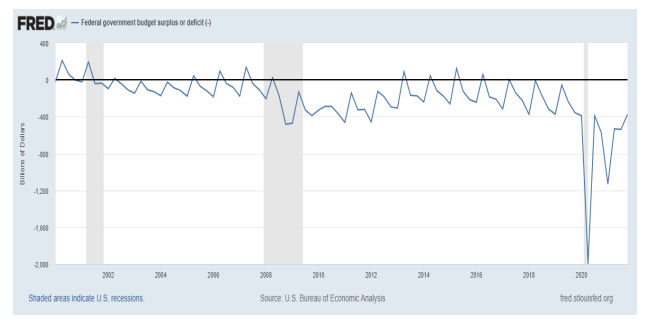

This is certainly not the only factor to consider regarding the future direction of inflation. For example, the debasement of currencies due to huge government deficits comes to the top of the list.

And financing these deficits is becoming enormously expensive as the Fed raises interest rates to attempt to ward off inflation.

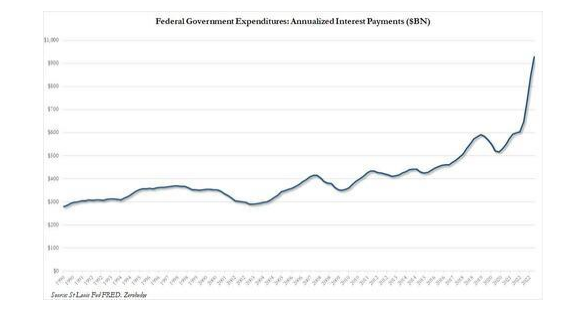

According to Bloomberg, the five-year Treasury yields are now about 3.96%, versus 1.35% at the start of last year. And according to the St Louis Fed's FRED and the BEA, the interest payments by the Federal Government have now surpassed $900 billion for the first time ever.

As lower-yielding securities mature, the Treasury faces even further increases in the rates it pays on outstanding debt.

The department’s data show the Fed’s blended rate on the debt will surpass 4% in one year.

That would mean that interest payments on total US debt of $32.3 trillion would hit $1.3 trillion within 12 months, potentially making interest on the debt the single biggest US government expenditure and surpassing social security!

As a result, an ominous trend is unfolding. The world is not unaware of the fiscal condition in the US and as a result, appear to be in the process of moving away from the dollar, thus chiseling away at the dollar's reserve status.

As tensions with Russia and China escalate, the so-called BRICS countries (Brazil, Russia, India, China, and South Africa) are they preparing to strike a blow against U.S. dollar hegemony?

In the first of the two most recent examples of how non-western nations plan to avoid the dollar, late last week Argentina made a loan repayment to the International Monetary Fund worth the equivalent of $2.7 billion “without using dollars” on Friday, using Chinese yuan and special-drawing rights notes instead, Reuters reported.

Indian refiners have also begun paying for some oil imports from Russia in Chinese yuan, Reuters also reported citing "sources with direct knowledge of the matter" as Western sanctions force Moscow and its customers to find alternatives to the dollar for settling payments.

The former Credit Suisse economist, Zoltan Poszar explains that the traditional idea of a unipolar world dominated by the US dollar is shifting, and we are entering an era where multiple currencies will play a significant role. Simply put, he notes, the global financial system is going through a "monetary divorce" from US dollar hegemony and becoming more multi-polar.

Such moves are weakening the purchasing power of the US dollar… which is the true definition of inflation. And although the financial markets, especially stocks have been in a strong recovery so far this year, a re-acceleration in inflation is a primary endogenous risk for stocks and bonds.

For the years following the 2008 Global Financial Crisis, exceptionally loose monetary policy ensured risk assets had a safety net. But central banks have been unable to rehabilitate the real economy and maintain fiscal constraints at the same time.

Government spending accelerated in the years leading up to the pandemic, and as shown above, continues at a rapid pace today.

The Federal Reserve’s creating money and lowering interest rates to backstop the financial markets is one thing, but to have an impact on the real economy, this newly printed money/debt must be spent, and governments have certainly been doing that.

As a result, the US economy now appears more reliant on government spending in an effort to shield the economy from job losses, ill health, high energy prices etc.

From a market perspective, these developments may very well lead to even larger deficits, a weaker dollar and structurally higher inflation.

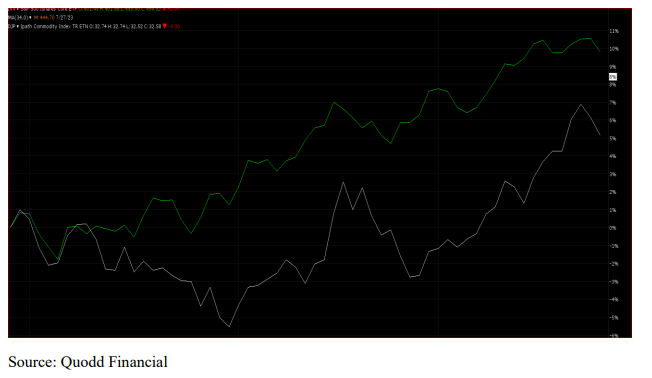

Could this be the catalyst for a shift from the bull markets in “paper assets” i.e., stocks and bonds to “real assets” i.e., commodities and precious metals?

After 15 years of dreadful underperformance, are real assets poised to finally begin outpacing stocks and bonds?

In the following chart is a 15-year comparison of the iShares S&P 500 ETF (Green) percentage change vs. the Barclays Bank iPath Commodity Index ETN (White).

Note the comparison for the past 3-month period.

So far, the US has successfully “bought time,” holding the system together with proverbial duct tape and paperclips. But eventually, time will run out. To quote Ayn Rand, “You can ignore reality, but you can’t ignore the consequences of ignoring reality.”

In light of this, what should an investor do?

My advice is to pay close attention to our capital flow indicators as summarized at the beginning of this report and described below, and as they change, so should the asset allocation of your portfolio.

In our seven asset classes listed, there are both inflation and deflation sensitive options. It is my belief that it would be prudent for investors to allocate a portion of their assets outside the traditional markets of stocks and bonds and into alternative asset classes. Some of these are included in our seven assets listed on page 1 of this report.

It is important to note that alternative investments can result in increased portfolio volatility and as with traditional investments like stocks and bonds, are not guaranteed and can decline in value.

Conclusion: Recognizing that we are in uncharted waters with multiple moving parts, we must admit that there is no way to tell in advance exactly how this will unfold. But in such a transitionary environment, the ability to properly anticipate change is predicated upon a detached analysis of information from multiple sources, applying that information to imagine a plausible world different from today’s, understanding how new data points fit (or don’t fit) into that world and adjusting accordingly.

Although this will be no easy feat, our answer at Consilience Asset Management is to employ a discipline that we believe has the ability to circumvent the effects of these uncertainties and disparities between the above noted risks and actual market action. Ultimately, it will be the forces of supply and demand that will drive prices of financial assets higher or lower, regardless of the fundamental, geopolitical or economic circumstances.

The cornerstone of our process is our Global Macro Capital Flow Model.

In this model, we monitor the movement of capital among the approximately $250 trillion of tradable global financial assets. Here, market trends can be identified regardless of their driver; debt, geopolitical, economic, or other…

Below is a picture of the distribution of the world’s liquid investment assets as a percent of the $250 trillion total…

By measuring the capital flows of each of these categories relative to the total, both favorable and unfavorable investment trends are identified.

At Consilience Asset Management, we employ this process in deploying client assets.

A more complete description of our model and process can be found on our website: www.consilienceassetmanagement.com under the tab “Our Process.”

Based on this, the ratings for each of the eight asset classes that we monitor are included each month at the beginning of this report.

We are entering a new phase, as the decade-long bull markets for stocks appear to be winding down. We are cognizant of the new challenges inherent due to the structural changes noted in this report, as they will have a huge impact on the current supply/demand dynamics in the global marketplace.

As such, we realize that these are clearly challenging and unprecedented times and therefore it is important for the astute investor to be nimble and pay close attention!

Consilience Asset Management

Roger Faulring – Managing Partner/Sr. Portfolio Manager/Investment Strategist

Michelle Malone – President/Investment Advisor

Donna Stone – Managing Partner/Investment Advisor

Roger Faulring is an Investment Adviser Representative (IAR) with and offers Investment Advisory Services through B. Riley Wealth Advisors, Inc., (BRWA) a SEC Registered Investment Adviser (RIA). BRWA and Consilience Asset Management are not affiliated.

All opinions and estimates included in this communication constitute the author’s judgment as of the date of this report and are subject to change without notice. The information provided is not directed at any investor or category of investors and is provided solely as general information about products and services or to otherwise provide general investment education. None of the information provided should be regarded as a suggestion to engage in or refrain from any investment-related course of action as neither B. Riley Wealth Management nor its affiliates are undertaking to provide you with investment advice or recommendations of any kind. Securities and variable insurance products offered through B. Riley Wealth Management, Inc., Member FINRA/SIPC.

*Our Global Macro Tactical Strategy seeks to identify favorable investment opportunities among seven primary asset classes. Capital is rotated to the specific markets in an effort to control risk by underweighting or eliminating exposure to markets that exhibit elevated risk.

*Our Relative Capital Flow Model is the cornerstone of our tactical allocation decisions and is augmented by our Behavior, Economic, Monetary and Stability indicators.

IMPORTANT NOTICES: The information contained in this electronic message (including any attachments) is privileged and confidential information intended only for the use of the recipient(s). Please notify the sender by email if you are not the intended recipient. If you are not the intended recipient, you are hereby notified that any dissemination, distribution or copying of this communication is strictly prohibited. B. Riley Capital Management, Inc. ("BRCM") does not accept time sensitive, actionoriented messages or transaction orders, including orders to purchase or sell securities, via email or by any other electronic means. BRCM reserves the right to monitor and review the content of all messages sent to or from this email address. Messages sent to or from this email address are stored by a third-party vendor and may be provided to regulators upon request. Neither the sender nor BRCM accepts any liability for any errors or omissions arising as a result of transmission. Any information contained in this electronic message is not an offer or solicitation to buy or sell any security, and while such information has been obtained from sources believed to be reliable, its accuracy is not guaranteed. Any references to the terms of executed transactions should be treated as preliminary only and subject to BRCM's formal written confirmation. This message is for information purposes only and is not an investment recommendation or a solicitation. Past performance is not indicative of future returns. All information is subject to change without notice. Unless indicated, these views are the author's and may differ from those of the firm or others in the firm. BRCM does not represent this is accurate or complete and may not update this information.