The Fed Wants to Save the Banks and Save the Dollar… But can it do Both?

As always, our Market Notes reports are available to you in PDF format. Click below to download.

First, an update:

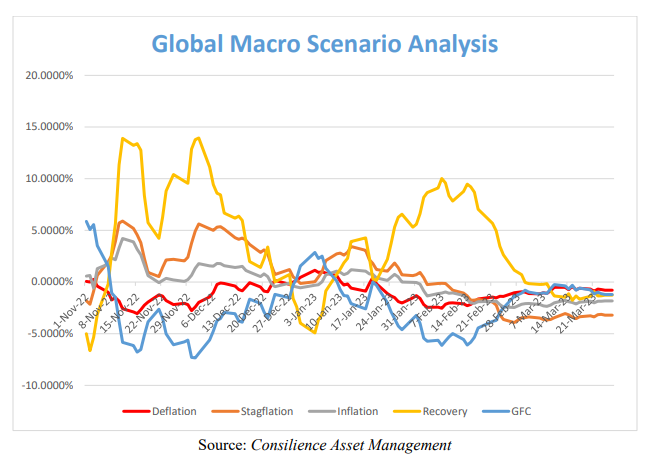

Last year, we at Consilience Asset Management added a Macro-Economic component to our Relative Capital Flow Model*. Using market action, through a process of reverse engineering, we seek to identify which macro-economic climate is being represented in the market at any given time.

This is an important addition to our discipline as central banks across the globe are attempting to unwind decades of monetary expansion. As this unwinding occurs, it could have significant ramifications for the financial market. Thus, there is an increased need to monitor this process and the corresponding macro-economic result.

Below are the ratings of the five scenarios that we are monitoring:

Inflation – Neutral,

Deflation – Neutral,

Stagflation – Negative,

Recovery – Neutral,

Financial Crisis – Neutral.

In prior months, our rating for the statistical likelihood of a recovery has been positive, and our rating for the likelihood of a financial crisis has been negative. In the past several weeks, both have changed. The recovery scenario has moved from positive to neutral and the financial crisis scenario from negative to neutral.

This suggests that the deterioration in the economy and lack of counter-stimulus from the Federal Reserve is negatively impacting the financial markets.

The above scenarios, reflect the current Capital Flow* composite rating of the securities that have historically generated positive returns in the above economic environments.

In addition, our Global Macro Indicators* are as follows for the seven asset classes we invest in for our clients:

Global Equities – Neutral,

Global Bonds – Neutral,

Commodities – Neutral,

Gold – Positive,

U.S. Dollar – Neutral,

Real Estate – Negative

Cryptocurrencies – Neutral.

Now, to this month’s report:

An introduction to the Fed’s dilemma…

First, they printed trillions of dollars following the 2008 Global Financial Crisis in a process called Quantitative Easing (QE) to “save” the economy and financial markets. This excessive capital resulted in inflation (a reduction in the purchasing power of the dollar).

Next, to fight the inflation that they created, they have attempted to reverse course and reduce dollars and raise interest rates in a process they call Quantitative Tightening (QT).

As a consequence, the stock and bond markets, which artificial rose as the Fed engaged in QE, began to decline as the Fed reversed course.

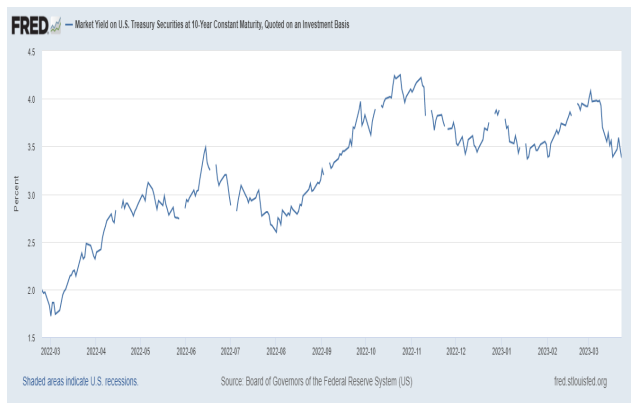

An unintended consequence was that embedded in the banking system are trillions of dollars of US Treasury Bonds. These bonds declined in value as the Fed raised rates resulting in liquidity problems and in some cases solvency problems in the banking system.

So, in an effort to protect the banks, they can reduce interest rates, allowing bonds to increase again and print more money to bail out insolvent banks.

But, in doing so, fighting inflation is discontinued, resulting in potentially higher inflation and a lower dollar.

They appear to have boxed themselves into a corner of their own making!

The financial policies of the past 30 years have created a delusional faith that there are no realworld scarcities or difficulties that can't be resolved with some new form of financial stimulus.

The fact is, the vast expansion of credit and leverage (sometimes call financialization), has fueled an astounding expansion of speculation in the financial markets which has become the engine of the global economy.

The reversal of financialization increases the cost of capital (interest rates, cost of mitigating rising risk) and the reversal of globalization increases the costs of goods and services.

Simply put, there is no way to conjure a hat-trick of financial gimmicks to reverse these forces of higher costs, where every unit of labor and currency buys less than it did in the past.

And now, the plan to rescue/stabilize the banking system once again creates the inflationary policies that brought us here in the first place.

It’s hard to believe that the Fed failed to recognize the effect their policies would have on the banking system. Until recently, nobody cared about the losses in the bank’s bond portfolios because, well, there simply weren't any. Interest rates were low and bond values were high.

But once the rate hikes started, bond started to decline in value, and the unrealized losses on the bank’s balance sheets started to climb.

And nowhere is this more visible than in Silicon Valley Bank's (SIVB) own balance sheet, where according to Morgan Stanley Equity Research, went from virtually no losses a year ago, to $16 billion vs. total shareholder equity of $15.8 billion… and thus insolvency.

The above is a somewhat oversimplification of the path to realized losses. Under current regulation, the losses are only recognized when the bonds are sold. In the case of SIVB, this was caused as a result of depositors losing faith in the bank and withdrawing funds at a rate that caused the bank to sell or realize the embedded/unrealized losses on their balance sheet.

To protect the US banking system from the potential of this spreading (contagion), they have established an emergency loan program that will enable them to inject as much as $2 trillion of funds into the US banking system to ease a potential liquidity crunch.

According to JPMorgan, this is a stealth form of QE which can serve to backstop the banking system’s impaired assets for the foreseeable future.

And just as was previously done, the Fed will create money out of thin air… which is inflationary, just like quantitative easing was.

In fact, this, for all intents and purposes, appears to be the return to quantitative easing.

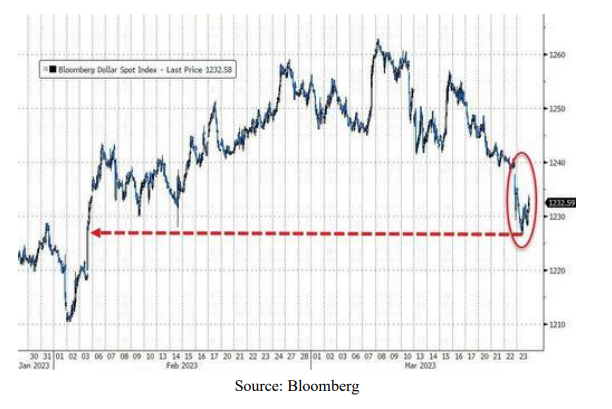

But if the Fed introduces another round of QE to save the banking system, how will they at the same time prevent the purchasing power of the dollar (inflation) from continuing its decent.

Mathematically, they can save one thing or the other. If they save the dollar, they will have to raise rates. To save the banking system, they will have to drop rates.

A bigger question is, how much confidence can we have that the Fed is even capable of solving either of these problems, problems that they have created in the first place.

My concern is illustrated in reviewing the analysis they did in 2022 to protect the system from the exact situation we find ourselves in today.

In its February 2022 Stress Test Scenarios, the Fed’s “severely adverse scenario” asked banks to assess their riskiness over a three-year horizon in a hypothetical world in which the 10-year Treasury yield falls to around 0.5%, then gradually rises to 1.5% later in the scenario.

As we have witness in 2023, their severely adverse scenario’s assumptions bore no relationship to reality. In February 2023, the three-month Treasury rate had already risen above 4.5%.

Considering the dilemma facing the Federal Reserve and the potential impact their actions will have on the financial markets, what should an investor do?

At Consilience Asset Management we regularly run stress tests which analyze multiple economic, geopolitical, and financial scenarios. One of these is a” “Fed Stress Test.” In our current simulation we simulate the impact of heightened stress in commercial real estate and debt/bond markets and the impact it will potentially have on the financial markets and portfolio adjustments that can be made in an effort to protect assets during such an outcome.

We have been presenting this analysis in recent client reviews. To receive a copy or to schedule your next formal portfolio review, please call or email our Administrative Manager, Sue Simpson at 716-768-1108 or ssimpson@consil.co.

My advice continues to be: Pay close attention to our capital flow indicators as summarized at the beginning of this report and described below, and as they change, so should the asset allocation of your portfolio.

In our seven asset classes listed, there are both inflation and deflation sensitive options. It is my belief that it would be prudent for investors to allocate a portion of their assets outside the traditional markets of stocks and bonds and into alternative asset classes. Some of these are included in our seven assets listed on page 1 of this report.

It is important to note that alternative investments can result in increased portfolio volatility and as with traditional investments like stocks and bonds, are not guaranteed and can decline in value.

Conclusion: Recognizing that we are in uncharted waters with multiple moving parts, we must admit that there is no way to tell in advance exactly how this will unfold. But in such a transitionary environment, the ability to properly anticipate change is predicated upon a detached analysis of information from multiple sources, applying that information to imagine a plausible world different from today’s, understanding how new data points fit (or don’t fit) into that world and adjusting accordingly.

Although this will be no easy feat, our answer at Consilience Asset Management is to employ a discipline that we believe has the ability to circumvent the effects of these uncertainties and disparities between the above noted risks and actual market action. Ultimately, it will be the forces of supply and demand that will drive prices of financial assets higher or lower, regardless of the fundamental, geopolitical, or economic circumstances.

The cornerstone of our process is our Global Macro Capital Flow Model.

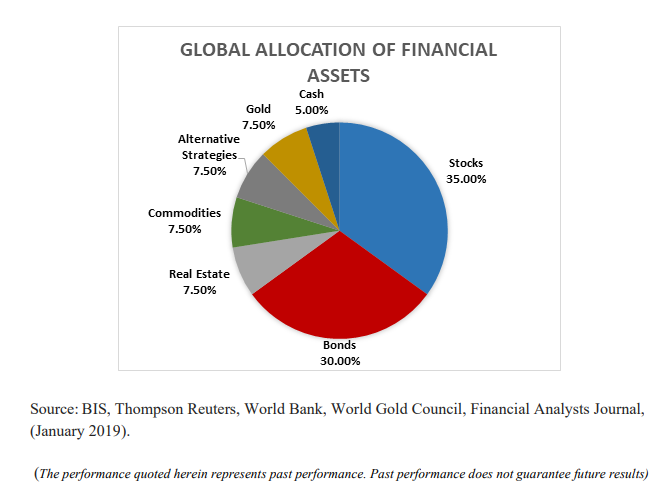

In this model, we monitor the movement of capital among the approximately $250 trillion of tradable global financial assets. Here, market trends can be identified regardless of their driver; debt, geopolitical, economic, or other…

Below is a picture of the distribution of the world’s liquid investment assets as a percent of the $250 trillion total…

By measuring the capital flows of each of these categories relative to the total, both favorable and unfavorable investment trends are identified.

At Consilience Asset Management, we employ this process in deploying client assets.

A more complete description of our model and process can be found on our website: www.consilienceassetmanagement.com under the tab “Our Process.”

Based on this, the ratings for each of the eight asset classes that we monitor are included each month at the beginning of this report.

We are entering a new phase, as the decade-long bull markets for stocks appear to be winding down. We are cognizant of the new challenges inherent due to the structural changes noted in this report, as they will have a huge impact on the current supply/demand dynamics in the global marketplace.

As such, we realize that these are clearly challenging and unprecedented times and therefore it is important for the astute investor to be nimble and pay close attention!

Consilience Asset Management

Roger Faulring – Managing Partner/Portfolio Manager/Market Strategist

Michelle Malone – President/Managing Partner

Donna Stone – Partner/Investment Advisor

Roger Faulring is an Investment Adviser Representative (IAR) with and offers Investment Advisory Services through B. Riley Wealth Advisors, Inc., (BRWA) a SEC Registered Investment Adviser (RIA). BRWA and Consilience Asset Management are not affiliated.

All opinions and estimates included in this communication constitute the author’s judgment as of the date of this report and are subject to change without notice. The information provided is not directed at any investor or category of investors and is provided solely as general information about products and services or to otherwise provide general investment education. None of the information provided should be regarded as a suggestion to engage in or refrain from any investment-related course of action as neither B. Riley Wealth Management nor its affiliates are undertaking to provide you with investment advice or recommendations of any kind. Securities and variable insurance products offered through B. Riley Wealth Management, Inc., Member FINRA/SIPC.

*Our Global Macro Tactical Strategy seeks to identify favorable investment opportunities among seven primary asset classes. Capital is rotated to the specific markets in an effort to control risk by underweighting or eliminating exposure to markets that exhibit elevated risk.

*Our Relative Capital Flow Model is the cornerstone of our tactical allocation decisions and is augmented by our Behavior, Economic, Monetary and Stability indicators.

IMPORTANT NOTICES: The information contained in this electronic message (including any attachments) is privileged and confidential information intended only for the use of the recipient(s). Please notify the sender by email if you are not the intended recipient. If you are not the intended recipient, you are hereby notified that any dissemination, distribution or copying of this communication is strictly prohibited. B. Riley Capital Management, Inc. ("BRCM") does not accept time sensitive, action-oriented messages or transaction orders, including orders to purchase or sell securities, via email or by any other electronic means. BRCM reserves the right to monitor and review the content of all messages sent to or from this email address. Messages sent to or from this email address are stored by a third-party vendor and may be provided to regulators upon request. Neither the sender nor BRCM accepts any liability for any errors or omissions arising as a result of transmission. Any information contained in this electronic message is not an offer or solicitation to buy or sell any security, and while such information has been obtained from sources believed to be reliable, its accuracy is not guaranteed. Any references to the terms of executed transactions should be treated as preliminary only and subject to BRCM's formal written confirmation. This message is for information purposes only and is not an investment recommendation or a solicitation. Past performance is not indicative of future returns. All information is subject to change without notice. Unless indicated, these views are the author's and may differ from those of the firm or others in the firm. BRCM does not represent this is accurate or complete and may not update this information.