Can the U.S. Continue to Fund its Rising Deficits?

Our Market Notes reports are available to you in PDF format. Click below to download.

First, an update:

Last year, we at Consilience Asset Management added a Macro-Economic component to our Relative Capital Flow Model*. Using market action, through a process of reverse engineering, we seek to identify which macro-economic climate is being represented in the market at any given time.

This is an important addition to our discipline as central banks across the globe are attempting to unwind decades of monetary expansion. As this unwinding occurs, it could have significant ramifications for the financial market. Thus, there is an increased need to monitor this process and the corresponding macro-economic result.

Below are the ratings of securities in the five scenarios that we are monitoring:

Inflation – Neutral,

Deflation – Neutral,

Stagflation – Negative,

Recovery – Neutral,

Financial Crisis – Positive.

The above scenarios reflect the current Capital Flow* composite rating of the securities that have historically generated positive returns in the above economic environments.

In addition, our Global Macro Indicators* are as follows for the seven asset classes we invest in for our clients:

Global Equities – Negative,

Global Bonds – Neutral,

Commodities – Positive

Gold – Positive

U.S. Dollar – Positive,

Real Estate – Negative,

Cryptocurrencies – Positive.

Now, to this month’s report:

Today most of the world uses a single currency, the U.S. dollar in order to buy nearly any product around the globe. This strengthens the price of the U.S. dollar. As a result, these countries are obliged to hold this currency in reserve to pay their bills. These countries do not hold the reserves in cash but invest them primarily in US Treasury Bonds to earn a return on their reserve holdings.

In this way, the U.S. has managed to create the largest bond market in the world.

After the start of the war in Ukraine, the West, led by the U.S., imposed sanctions on Russia and froze the foreign currency reserves of the Russian Central Bank.

This has led to a backlash against using the US Dollar by many nations, primarily members of the BRICS nations, Brazil, Russia, China, India, and South Africa.

This group of five nations has recently expanded their membership to eleven and there is evidence that an additional 40 nations have applied to join.

These nations have vowed to circumvent the current structure and attempt to use alternative currencies in their global trading.

This represents a huge problem for the U.S. if, as a result, they reduce their U.S. dollar holdings. Why? Because the U.S. depends on these nations to finance our large and growing debt.

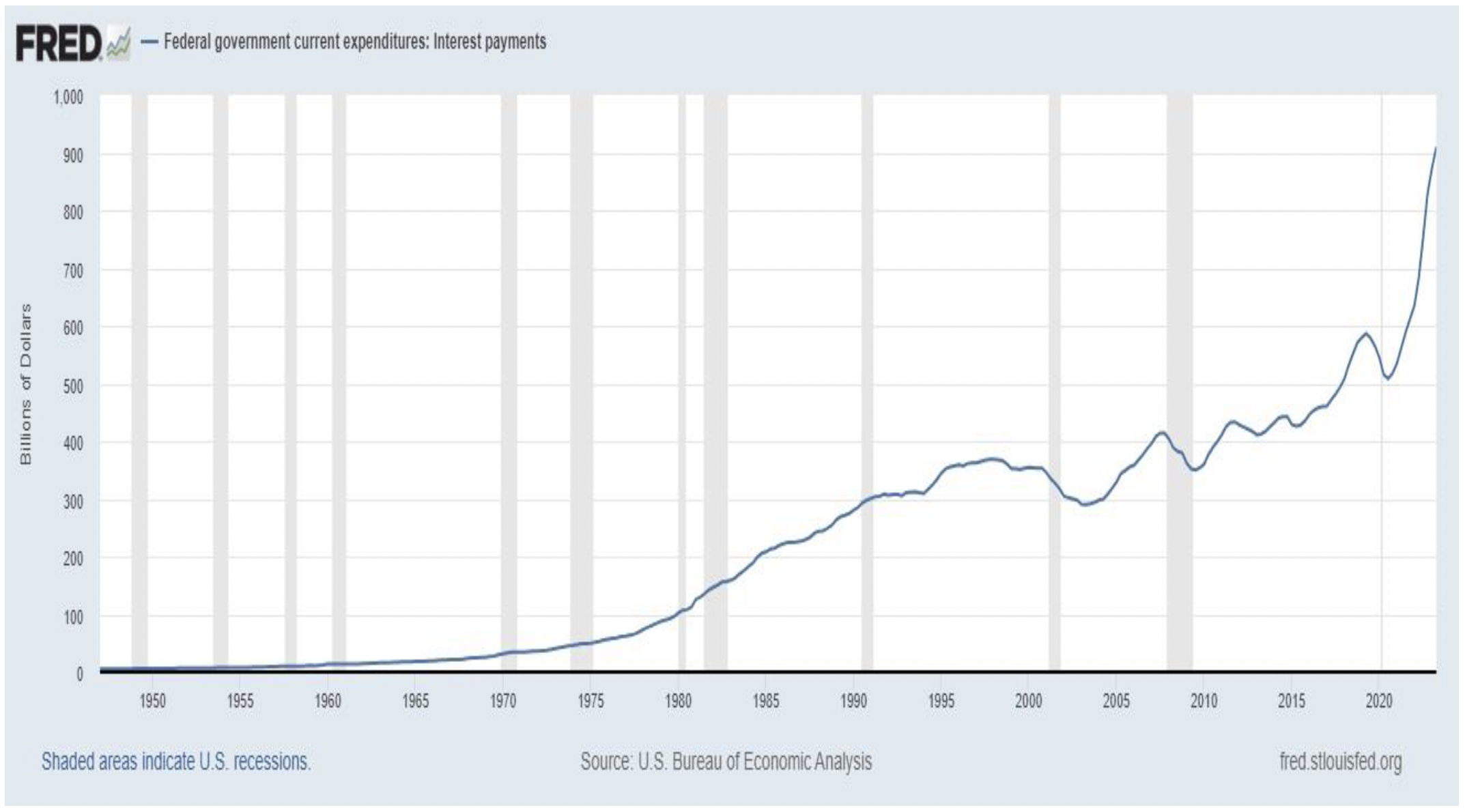

Total U.S. debt has almost quadrupled since the 2008 Global Financial Crisis. And we are approaching $1 Trillion in interest expense!

The next chart from the Peterson Foundation shows that we appear to be on an unsustainable path.

In addition to financing the existing debt of over $33 Trillion, future deficits will be added to this. And if, as shown above, the BRICS nations reduce their need for US dollars, it may require even higher interest rates to attract buyers of U.S. Treasury obligations.

If there still are not enough buyers, the U.S. will need to print new dollars to buy the unsold bonds. These newly printed dollars will further debase the purchasing power of the dollar resulting in even higher inflation.

But hasn’t the Federal Reserve taken steps to reduce the money supply, thus helping to offset the above stated risks?

If we look at a chart of the steps taken by the Fed during the past year, it appears to be encouraging…

They have clearly taken steps to reduce the U.S. money supply. But is this enough? Let’s look at the picture in its larger context…

Download here for more information.